Expand/Close Accordion 1

What is Receivables Financing?

Receivables Financing, which is also known as Factoring, provides businesses the option of receiving upfront funding for their invoices rather than waiting 30, 60 or even 90 days to receive payment. It is not a loan, but rather an advance of the invoiced amount minus a small fee, called a discount, and a refundable reserve between 5% and 20%, depending on your clients' credit standing and payment history. The reserve is refunded when the invoices are paid.

Expand/Close Accordion 2

How long does it take to receive funding?

Once the factoring agreement is signed, initial funding typically occurs in three business days or less. After initial funding, subsequent funding occurs, on average, the same business day. Variations may occur based on the amount requested and complexity of the case. Our cash flow experts will walk you through the specifics and provide a concrete timeline.

Expand/Close Accordion 3

What fees will I pay?

When opening the line, there is a one-time $65 UCC Search and Filing Fee. We purchase your receivables at a small discount and hold a refundable reserve, which starts at 5% of the invoice value, during collections. The reserve is returned to the business when the corresponding invoices are paid. Discounts are small fees charged to cover the costs associated with providing this service. The amount of the discount starts at 1%. Estimate your cash advance amount.

Expand/Close Accordion 4

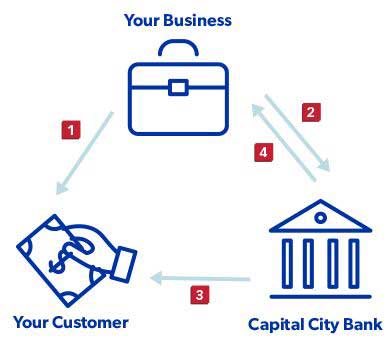

How does Factoring work?

Factoring from Capital City Bank transforms your receivables into cash you can put immediately to work in your business.

Here's how it works:

Here's how it works:

Expand/Close Accordion 5

What happens if an invoice is not paid?

At the end of the 90 days, any unpaid invoices are offset with your collective reserves and transferred back to you.

Expand/Close Accordion 6

Will I receive the entire reserve back at the end of the 90-day collections cycle?

As invoices are paid, the amount of the reserve associated with those invoices is returned to you. The amount held in reserve is adjusted as factored invoices are paid and new invoices are sold.

Expand/Close Accordion 7

Is the discount refundable?

No, the discount is a fee that helps cover the costs associated with providing this service, including assistance with collections and reporting. Discounts start at 1%. Estimate your cash advance amount.

Expand/Close Accordion 8

How do you determine the amount of discount/reserve charged?

Discounts start at 1% and reserves start at 5%. Both are calculated based on the credit standings and payment histories of your clients. Estimate your cash advance amount.

Expand/Close Accordion 9

If Capital City Bank is handling collections, how will my customer relationships be affected?

Invoices purchased via Factoring will be paid directly to the Capital City Bank lockbox, but all communications are sent on your company letterhead, preserving your relationship, if that is your desire. We provide our contact information when invoicing on your behalf, so any questions come straight to us.

Expand/Close Accordion 10

Expand/Close Accordion 11

Expand/Close Accordion 12

Expand/Close Accordion 13

Expand/Close Accordion 14

Expand/Close Accordion 15

Expand/Close Accordion 16

Expand/Close Accordion 17

Expand/Close Accordion 18

Expand/Close Accordion 19

Expand/Close Accordion 20

Expand/Close Accordion 21

Expand/Close Accordion 22

Expand/Close Accordion 23

Expand/Close Accordion 24

Expand/Close Accordion 25

Expand/Close Accordion 26

Expand/Close Accordion 27

Expand/Close Accordion 28

Expand/Close Accordion 29

Expand/Close Accordion 30

Expand/Close Accordion 31

Expand/Close Accordion 32

Expand/Close Accordion 33

Expand/Close Accordion 34

Expand/Close Accordion 35

Be more competitive while improving your cash flow, credit rating and supplier discounts Waiting 30+ days for payment on an invoice ties up your working capital. With Factoring from Capital City Bank, we advance you those funds so you don't have to put your business on hold. Use it how you need it: meet payroll, grow your company and pay suppliers.

Expand/Close Accordion 36

Accelerate your cash flow.

Factoring pays cash for your receivables in minutes, not months. A quick and easy solution to your cash-flow challenges.

Expand/Close Accordion 37

No loans, no interest to pay.

Capital City Bank buys your accounts receivables and advances you up to 90% of that amount to cover your expenses and invest back in your business. It’s an asset, not a liability, so there is no interest to pay.

Expand/Close Accordion 38

Seize growth opportunities without adding new debt.

By transforming your receivables into cash, Factoring gives you the means to reinvest in whatever your business needs to grow using assets you already own.

Expand/Close Accordion 39

Pay down your liabilities.

Get the cash you need to pay those you owe sooner than with standard invoicing. Then take advantage of early payment discounts.

Expand/Close Accordion 40

Management of your accounts receivables.

We take on the collections risk and responsibility so you can redirect your time and your staff toward sales-generating activities. We send 30 and 60-day collection letters and provide regular status reports. Plus, our secure web portal allows you to log in and view your reporting in real time.

Expand/Close Accordion 41

Scalable financing to support business growth.

Because you're not locked in to a long-term contract or a rigid loan agreement, you have the flexibility to adjust your line as the demands on your business change.

Expand/Close Accordion 42

Expand/Close Accordion 43

Expand/Close Accordion 44

Expand/Close Accordion 45

Expand/Close Accordion 46

Expand/Close Accordion 47

Expand/Close Accordion 48

Expand/Close Accordion 49

Expand/Close Accordion 50

Expand/Close Accordion 51

Expand/Close Accordion 52

Expand/Close Accordion 53

Expand/Close Accordion 54

Expand/Close Accordion 55

Expand/Close Accordion 56

Expand/Close Accordion 57

Expand/Close Accordion 58

Expand/Close Accordion 59

Expand/Close Accordion 60

Expand/Close Accordion 61

Expand/Close Accordion 62

Expand/Close Accordion 63

Expand/Close Accordion 64

Expand/Close Accordion 65

Expand/Close Accordion 66

Expand/Close Accordion 67

Expand/Close Accordion 68

Expand/Close Accordion 69

Expand/Close Accordion 70

Expand/Close Accordion 71

Expand/Close Accordion 72

Expand/Close Accordion 73

Expand/Close Accordion 74

Expand/Close Accordion 75

Expand/Close Accordion 76

Expand/Close Accordion 77

Expand/Close Accordion 78

Expand/Close Accordion 79

Expand/Close Accordion 80

Expand/Close Accordion 81

Expand/Close Accordion 82

Expand/Close Accordion 83

Expand/Close Accordion 84

Expand/Close Accordion 85

Expand/Close Accordion 86

Expand/Close Accordion 87

Expand/Close Accordion 88

Expand/Close Accordion 89

Expand/Close Accordion 90

Expand/Close Accordion 91

Expand/Close Accordion 92

Expand/Close Accordion 93

Expand/Close Accordion 94

Expand/Close Accordion 95

Expand/Close Accordion 96

Expand/Close Accordion 97

Expand/Close Accordion 98

Expand/Close Accordion 99

Expand/Close Accordion 100

Expand/Close Accordion 101

Expand/Close Accordion 102

Expand/Close Accordion 103

Expand/Close Accordion 104

Expand/Close Accordion 105

Expand/Close Accordion 106

Expand/Close Accordion 107

Expand/Close Accordion 108

Expand/Close Accordion 109

Expand/Close Accordion 110

Expand/Close Accordion 111

Expand/Close Accordion 112

Expand/Close Accordion 113

Expand/Close Accordion 114

Expand/Close Accordion 115

Expand/Close Accordion 116

Expand/Close Accordion 117

Expand/Close Accordion 118

Expand/Close Accordion 119

Expand/Close Accordion 120

Expand/Close Accordion 121

Expand/Close Accordion 122

Expand/Close Accordion 123

Expand/Close Accordion 124

Expand/Close Accordion 125

Expand/Close Accordion 126

Expand/Close Accordion 127

Expand/Close Accordion 128

Expand/Close Accordion 129

Expand/Close Accordion 130

Expand/Close Accordion 131

Expand/Close Accordion 132

Expand/Close Accordion 133

Expand/Close Accordion 134

Expand/Close Accordion 135

Expand/Close Accordion 136

Expand/Close Accordion 137

Expand/Close Accordion 138

Expand/Close Accordion 139

Expand/Close Accordion 140

Expand/Close Accordion 141

Expand/Close Accordion 142

Expand/Close Accordion 143

Expand/Close Accordion 144

Expand/Close Accordion 145

Expand/Close Accordion 146

Expand/Close Accordion 147

Expand/Close Accordion 148

Expand/Close Accordion 149

Expand/Close Accordion 150

Expand/Close Accordion 151

Expand/Close Accordion 152

Expand/Close Accordion 153

Expand/Close Accordion 154

Expand/Close Accordion 155

Expand/Close Accordion 156

Expand/Close Accordion 157

Expand/Close Accordion 158

Expand/Close Accordion 159

Expand/Close Accordion 160

Expand/Close Accordion 161

Expand/Close Accordion 162

Expand/Close Accordion 163

Expand/Close Accordion 164

Expand/Close Accordion 165

Expand/Close Accordion 166

Expand/Close Accordion 167

Expand/Close Accordion 168

Expand/Close Accordion 169

Expand/Close Accordion 170

Expand/Close Accordion 171

Expand/Close Accordion 172

Expand/Close Accordion 173

Expand/Close Accordion 174

Expand/Close Accordion 175

Our cash-flow experts are equipped to analyze your situation and structure an effective solution for you. To get started right away, contact us at 850.402.7537 or businesswcf@ccbg.com(Opens in a new Window).